Whitepaper: The Gorilla Blockchain Solution

I. Introduction

Blockchain technology has revolutionized decentralized applications (dApps), decentralized finance (DeFi), and digital assets by offering decentralized, transparent, and immutable systems. However, the fundamental obstacles of scalability, latency, and energy consumption hinder the performance and wider adoption of blockchain networks.

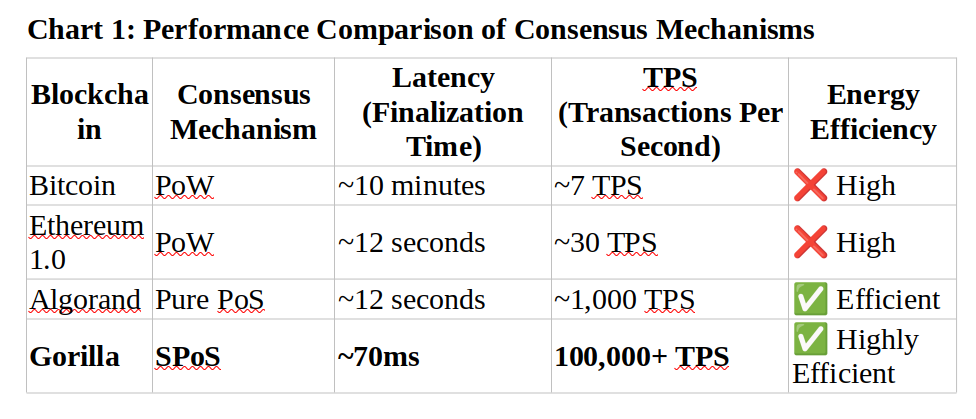

While many current blockchain networks like Bitcoin (PoW) and Ethereum (PoS) have made strides in achieving decentralization and security, they still suffer from limited throughput, long transaction confirmation times, and high energy consumption. Additionally, they struggle with maintaining decentralization as the network scales.

Identifying the ChallengesTo build a truly scalable blockchain system, Gorilla tackles the following core challenges:

- Decentralization – Ensuring a trustless system without single points of failure.

- Security – Implementing cryptographic security measures to prevent attacks.

- Scalability – Enabling a high-throughput system that competes with centralized solutions.

- Efficiency – Reducing computational overhead and power consumption.

- Bootstrapping and storage enhancement: this ensures a competitive cost for data storage and synchronization;

- Data Storage & Synchronization – Ensuring seamless data propagation across nodes.

- Cross-Chain Interoperability – Enabling decentralized applications (dApps) across networks.

Gorilla is positioned to address these challenges with state-of-the-art innovations like Adaptive State Sharding, Secure Proof of Stake (SPoS), Threshold Cryptography, and High-Frequency Trading (HFT) integration. These advancements aim to provide the necessary scalability, decentralization, and security to rival centralized systems while optimizing performance.

Key Features of Gorilla:- State-of-the-art scalability through Adaptive State Sharding.

- Optimized transaction finalization using Secure Proof of Stake (SPoS).

- Energy-efficient and secure consensus mechanisms with Threshold Cryptography.

- Real-time arbitrage and High-Frequency Trading (HFT) integration.

II. Gorilla Blockchain Architecture

Gorilla Network Overview

The Gorilla Blockchain architecture is designed to overcome the scalability and latency challenges of traditional blockchains through the use of sharding, high-frequency trading integration, and adaptive consensus mechanisms.

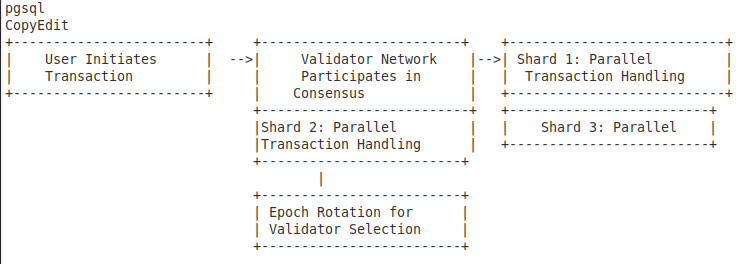

Diagram 1: Gorilla Blockchain Network Architecture

This architecture involves users initiating transactions, validators authenticating and participating in consensus, and multiple shards handling parallel transactions across partitions. The Epoch Rotation mechanism ensures fair validator selection and prevents centralization.

III. Consensus Mechanism: Secure Proof of Stake (SPoS)

SPoS Overview

Gorilla’s Secure Proof of Stake (SPoS) enhances traditional Proof of Stake (PoS) by introducing a weighted validator selection process and leveraging Threshold Cryptography for Byzantine Fault Tolerance (BFT).

Key Technical Enhancements:

- Latency Reduction:

Gorilla SPoS enables 70ms finalization time, drastically reducing transaction confirmation compared to Proof of Work (PoW) and PoS networks (e.g., Bitcoin, Ethereum 1.0). Validator Selection:

Validators are chosen based on both stake size and performance metrics, dynamically adjusted to ensure fairness.

Example Calculation:

- Validator A Stake: 1000 tokens, Performance Score: 90%

- Validator B Stake: 2000 tokens, Performance Score: 85%

The weighted selection mechanism assigns a higher chance of selection to Validator B due to a larger stake.

Formula:

Validator Selection Probability = (Validator Stake × Performance Score) / Total Stake & Performance

- Threshold Cryptography:

BLS Signatures (Boneh-Lynn-Shacham) are used to aggregate signatures and maintain consensus while reducing computational load, significantly enhancing scalability.

IV. Adaptive State Sharding for Scalability

State Sharding Overview

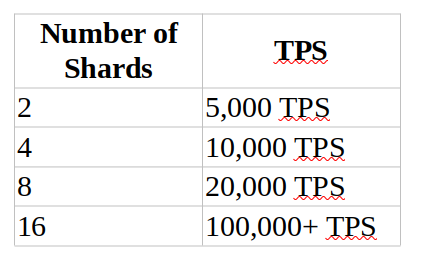

State Sharding enables parallel processing by dividing the blockchain network into multiple shards, each handling a subset of transactions. This eliminates the bottleneck seen in single-chain blockchains and ensures linear scalability.

Dynamic Sharding Mechanism:

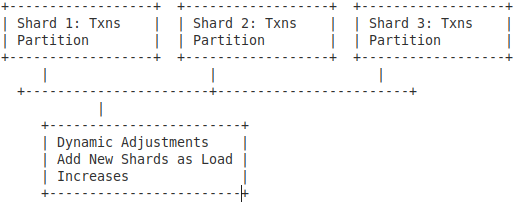

- Adaptive Partitioning:

The network dynamically adjusts the number of shards based on real-time transaction load. As demand increases, new shards are created to ensure the network can scale efficiently. - Epoch-Based Redistribution:

Validators are rotated across shards in predefined epochs to prevent centralization and enhance security.

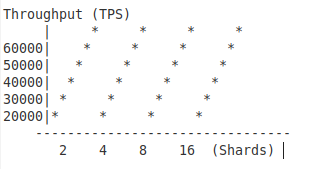

Chart 2: Transactions Per Second (TPS) vs. Shard Count

Diagram 2: Sharding Architecture

pgsql

CopyEdit

Each shard handles a fraction of the transaction load, improving efficiency. As the transaction load increases, new shards are dynamically introduced to maintain optimal performance.

V. Arbitrage Trading & High-Frequency Trading (HFT)

HFT Integration

High-Frequency Trading (HFT) demands ultra-low latency and high throughput. Gorilla’s blockchain, with sub-millisecond consensus times, is ideal for integrating automated trading algorithms and arbitrage strategies.

Technical Breakdown of HFT Execution:

- Automated Arbitrage:

Smart contracts are deployed to automatically detect price inefficiencies across decentralized exchanges (DEXs). - Low-Latency Execution:

Sub-millisecond execution enables real-time arbitrage opportunities to be captured with no delay.

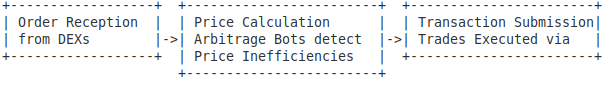

Flowchart 1: HFT Execution Process

pgsql

CopyEdit

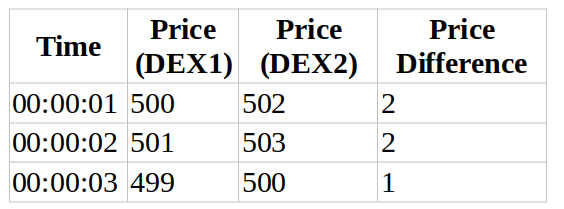

Chart 3: Price Discrepancy in Cross-Exchange Arbitrage

The graph illustrates how price discrepancies across exchanges can be captured and exploited using Gorilla’s smart contracts.

VI. Arbitrage Environment

Arbitrage trading with smart contracts involves leveraging the capabilities of blockchain-based smart contracts to automate and execute arbitrage strategies in decentralized finance (DeFi) ecosystems. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They run on blockchain networks and automatically enforce the rules and conditions of the contract.

Here’s how arbitrage trading with smart contracts typically works in the context of DeFi:

Engagement with the Established Network:

Engagement with an established network to obtain smart contracts for arbitrage trading in DeFi typically involves several steps:

- Research and Networking:

Developers start by researching and networking within the DeFi community to identify reputable individuals, teams, or organizations that specialize in developing smart contracts for arbitrage trading. This could involve attending blockchain conferences, joining online forums and communities, and networking with experienced professionals in the DeFi space. - Due Diligence:

Before engaging with any party to obtain smart contracts, it’s important to conduct due diligence to assess their credibility, track record, expertise, and reputation within the DeFi ecosystem. This may include reviewing past projects, examining code repositories, and seeking references or testimonials from previous clients. - Engagement and Collaboration:

Once a suitable partner or development team is identified, traders engage in discussions to outline their specific requirements, objectives, and expectations for the smart contracts. This could involve defining the arbitrage strategies, specifying parameters and conditions, and discussing technical considerations such as security, scalability, and interoperability with existing DeFi protocols. - Contract Negotiation:

The network and developers negotiate the terms and conditions of the contract, including pricing, payment terms, delivery timelines, support services, and any other relevant agreements. - Contract Development and Review:

The development team proceeds to create, test, and deploy the smart contracts according to the agreed-upon specifications. Developers may have the opportunity to review and provide feedback on the development progress, conduct code audits, and verify the functionality and security of the smart contracts before they are finalized. - Deployment and Integration:

Once the smart contracts are completed and thoroughly vetted, they are deployed onto the appropriate blockchain network or platform. Agents work closely with the development team to integrate the smart contracts into their arbitrage infrastructure, connect to relevant DeFi protocols, and ensure seamless execution of arbitrage sessions with the clients that are pre-booked for the deals. - Ongoing Support and Optimization:

After deployment, traders may require ongoing support, maintenance, and optimization services incorporating updates or enhancements to adapt to changing market conditions.

- Research and Networking:

By following these steps and engaging with established networks in the DeFi community, developers can obtain high-quality smart contracts for arbitrage trading that align with their objectives and help them capitalize on emerging opportunities.

VII. Security Mechanisms: Sybil Resistance & Byzantine Fault Tolerance

Sybil Resistance with SPoS

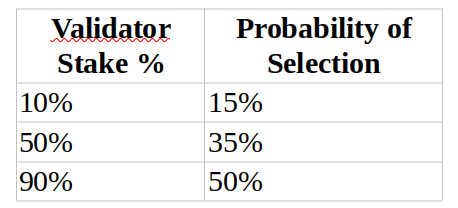

Gorilla’s Secure Proof of Stake (SPoS) prevents Sybil attacks by randomly selecting validators based on stake size and performance metrics. Validators with a higher stake and performance score are more likely to be selected for consensus, making it difficult for malicious actors to flood the network with fake validators.

Chart 6: Validator Weight Distribution

This chart highlights how validators with higher stakes are more likely to be selected, making Sybil attacks much harder to execute.

VIII. Epoch-Based Node Rotation & Randomness Generation

Epoch Transitions for Security & Fairness:

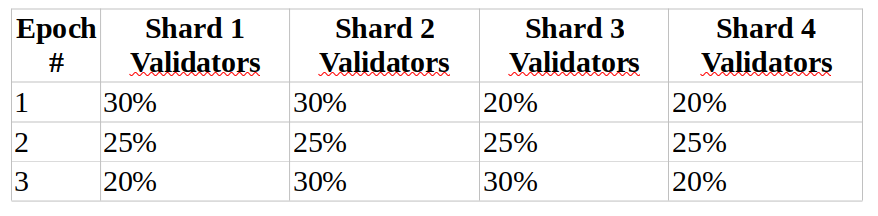

Each epoch represents a set period during which the shard configuration and validator assignments remain fixed. Node rotation is used to ensure fairness and avoid collusion or centralization.

Chart 5: Validator Distribution Across Epochs

IX. Security Mechanisms: Sybil Resistance and Byzantine Fault Tolerance

Sybil Resistance with SPoS:

Gorilla’s Secure Proof of Stake prevents Sybil attacks by randomly selecting validators based on stake size and performance metrics.

Chart 6: Validator Weight Distribution

This chart highlights how validators with higher stakes are more likely to be selected, preventing Sybil attacks.

X. Epoch-Based Node Rotation and Randomness Generation

The protocol employs an epoch-based node rotation mechanism to prevent collusion. Each epoch spans a fixed duration (e.g., 7 days), during which shard configurations remain stable.

Key epoch transition steps:

- Node Assignment – New nodes remain in a pending state until the next epoch.

- Shard Reallocation – Less than 1/2 of nodes are reshuffled per epoch.

- Adaptive Scaling – The number of shards dynamically adjusts based on network demand.

- Validator Eligibility Update – Newly added nodes are distributed uniformly across shards.

Redundancy and Performance Optimization

Sibling shards maintain redundant copies of blockchain state, allowing seamless merges if node participation decreases. This guarantees network liveness and prevents bottlenecks.

Performance Benchmarking

Simulations indicate that the protocol can scale linearly with the number of participating nodes.

Chart 2: TPS Performance Benchmarks

Throughput (TPS)

XI Conclusion: Towards Decentralization & Scalability

Future Roadmap:

- 2025: AI optimizations for transaction routing.

- 2026: Integration of Zero-Knowledge Proofs (ZKPs) for enhanced privacy.

- 2027: Cross-chain interoperability via IBC (Inter-Blockchain Communication).