The Way of Arbitrage: Optimized Arbitrage

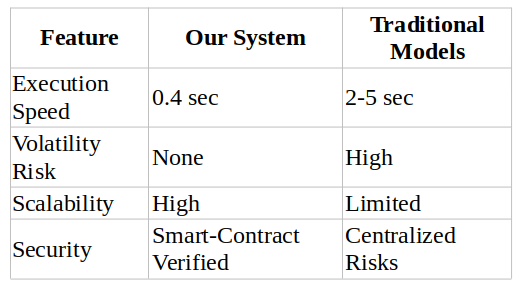

We specialize in over-the-counter (OTC) arbitrage and use pre-agreed contracts to ensure execution in less than 0.4 seconds with zero volatility. Our system is designed for high-speed execution, scalable operations, and secure transactions across a massive swapping network.

Main features of our arbitrage model

- Agreements made in advance eliminate market volatility.

- Transactions are processed in less than 0.4 seconds.

- Fixed-price contracts ensure stability.

- Direct connections to multiple liquidity pools enable seamless trade execution.

1. Arbitrage ecosystem

A structured approach to high-speed swapping:

Calculation: Advantage of execution speed

Considering that a conventional arbitrage model takes on average 3 seconds and our system executes within 0.4 seconds:

Our system is 7.5 times faster than traditional arbitrage models.

2. Smart contract network

Our advanced payment system uses smart contracts for:

- LPoS: The stake is distributed among several validators, which ensures decentralization

- Centralized staking: Few locations control the network

Calculating the strength of decentralization:

Suppose a network with 100 verifiers:

- Immediate billing – no manual processing deadlines.

- Secure transactions – Verified trade execution with immutable blockchain records.

- Automated trade execution – Eliminates human error and maximizes efficiency.

Step-by-step execution of smart contracts

- Trade initialization: Buy/sell request sent to the smart contract.

- Verification: The smart contract confirms the pre-agreed conditions.

- Execution: The trade is completed immediately.

- Settlement: The funds are distributed without delay.

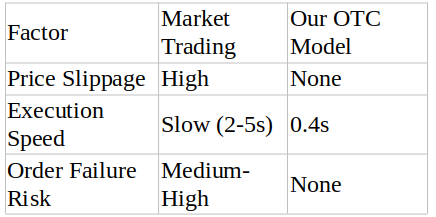

3. OTC transactions and stability

- Pre-arranged trade contracts – ensuring fixed pricing without volatility.

- Fast execution – transactions are completed in less than 0.4 seconds.

- Stable pricing – no risk of price fluctuations.

Market volatility vs. OTC stability

Since our OTC model has zero variance, it is infinitely more stable.

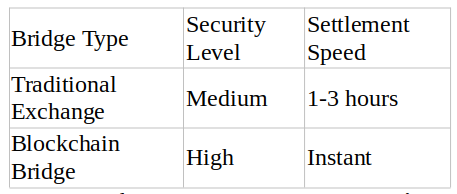

4. Security and interoperability of the blockchain

To increase efficiency, we implement blockchain bridges that enable secure cross-chain transactions.

Example: Wrapped Bitcoin (wBTC)

- BTC is embedded in a smart contract.

- The equivalent of wBTC is issued on Ethereum.

- This enables efficient cross-chain trading without conversion risks.

Blockchain bridge efficiency comparison

Our cross-chain transactions are 27,000 times faster than traditional exchanges.

Why should you choose our arbitrage system?