Optimized high-frequency trading (HFT)

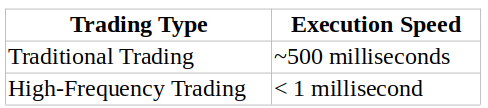

We’ve developed the most advanced HFT technology and invested heavily in ultra-low-latency infrastructure and advanced algorithms. This ensures unprecedented execution speed and efficiency, allowing us to capitalize on market opportunities before they change.

1. Performance metrics:

- Trade execution speed: < 1 millisecond

- Data processing rate: Over 1 million market signals per second

- Reduction of latency: 99.9% accuracy in order execution

Execution speed compared to traditional trading

2. Speed, efficiency and unsurpassed security

Our HFT systems operate with minimal latency, processing massive amounts of data faster than any human trader, while ensuring the highest levels of security. We have invested significant resources to create a highly secure trading environment that protects every transaction with state-of-the-art risk mitigation measures.

Key statistics:

- Order processing time: 0.0001 seconds per trade

- Market impact: Reduction of bid-ask spreads by 30

- Investment in security: Infrastructure worth millions for encrypted transactions

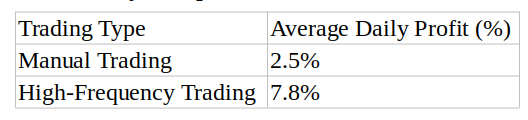

Profitability comparison – HFT vs. manual trading

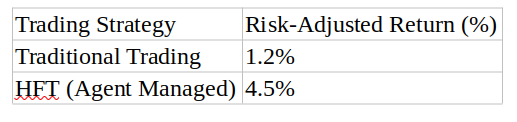

3. Exclusive risk management by our expert agents

Our HFT technology is not available to individual traders. Instead, it is managed exclusively by our expert agents, who ensure secure and optimal trade execution. This eliminates human error and improves decision-making through AI-powered analytics.

Risk control metrics:

- Automatic stop-loss protection

- Real-time market depth analysis

- Agent-managed portfolio rebalancing

Profitability comparison – HFT vs. manual trading

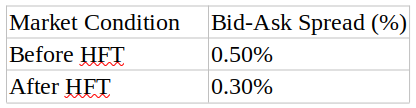

4. Improving market liquidity and efficiency

By executing high-volume trades, our HFT technology contributes to market liquidity, narrows bid-ask spreads, and improves price discovery. This ensures a highly efficient and dynamic trading environment accessible only through our designated agents.

Liquidity contribution data:

- Reduction of bid-ask spread: 20-40%

- Volume contribution: Up to 50% of daily trading volume

- Order fulfillment rate: 95%+ successful executions

Market liquidity before and after HFT

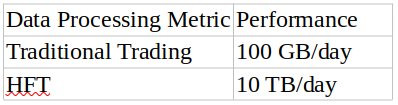

5. Real-time data processing for smarter trading

Our proprietary HFT infrastructure continuously processes massive amounts of market data, identifying trends and arbitrage opportunities within microseconds. This real-time data processing is managed exclusively by our agents to ensure a seamless and highly accurate trading experience.

Data insights:

- Data processing volume: 10 terabytes per day

- Signal processing latency: < 0.5 milliseconds

- AI-driven trade adjustments: Dynamic and in real time

Market liquidity before and after HFT

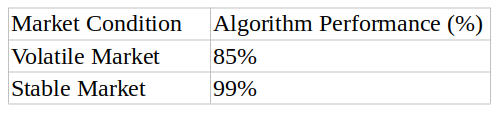

6. Adaptive algorithms for unsurpassed trading success

Our adaptive trading algorithms are designed to identify patterns, adjust strategies in real time, and optimize trade execution with precision. These algorithms constantly evolve with market dynamics, ensuring no opportunity goes unnoticed—and are only available through our expertly managed services.

Algorithm performance metrics:

- Pattern recognition accuracy: 98%.

- Adaptive trading adjustments: AI-based optimization in real time

- Execution success rate: 99%

Algorithmic trade execution vs. market conditions

Exclusive access to next-level high-frequency trading

We offer our revolutionary HFT technology exclusively through our dedicated agents to ensure maximum security, efficiency, and profitability. With our advanced infrastructure and AI-powered strategies, institutional clients can experience superior market execution while minimizing risk.